Backdoor Roth Rules 2024

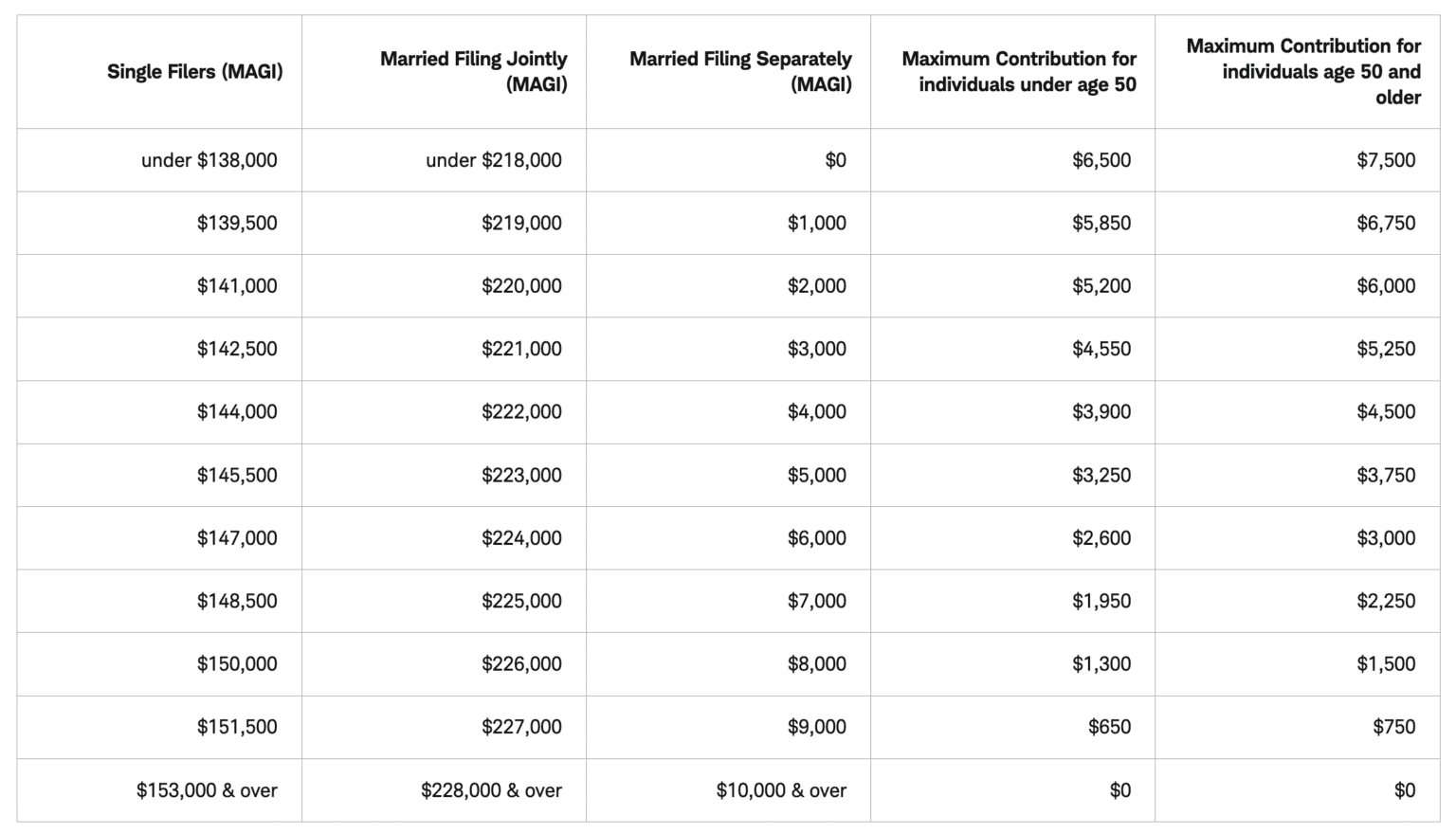

Backdoor Roth Rules 2024. The phaseout occurs between $146,000 and $161,000 for single filers and $230,000 and $240,000 for joint filers in 2024. That’s because the rules for backdoor roth iras aren’t intuitive.

The backdoor method allows those with. Here’s how those contribution limits stack up for the 2023 and 2024 tax years.

Here's How Those Contribution Limits Stack Up For The 2023 And 2024 Tax Years.

How does their projected 2024 income compare to a normal income year?

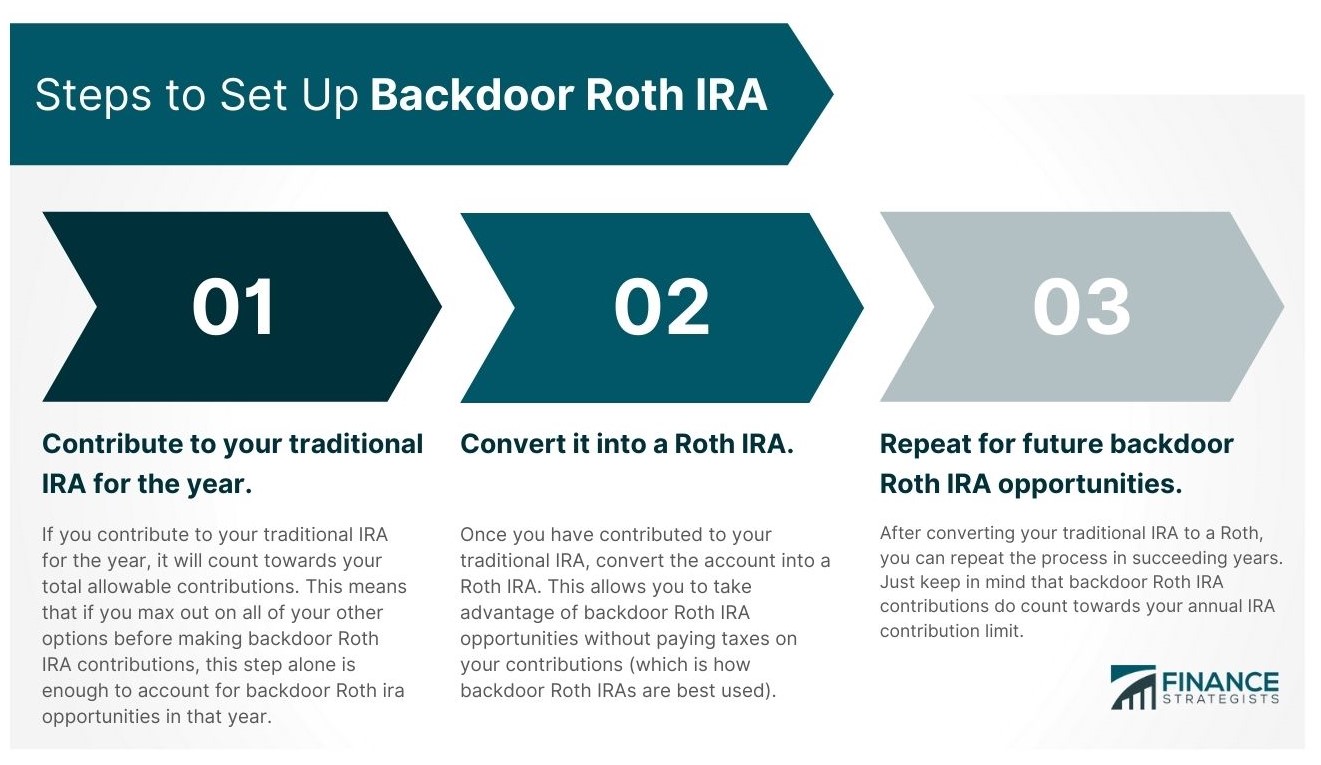

Contribute To A Traditional Ira.

The phaseout occurs between $146,000 and $161,000 for single filers and $230,000 and $240,000 for joint filers in 2024.

That’s Because The Rules For Backdoor Roth Iras Aren’t Intuitive.

Images References :

Source: choosegoldira.com

Source: choosegoldira.com

backdoor roth ira withdrawal rules Choosing Your Gold IRA, You cannot deduct contributions to a roth ira. A backdoor roth ira is a roth ira that is created when those who cannot open roth iras due to income limits convert their traditional iras into a roth ira.

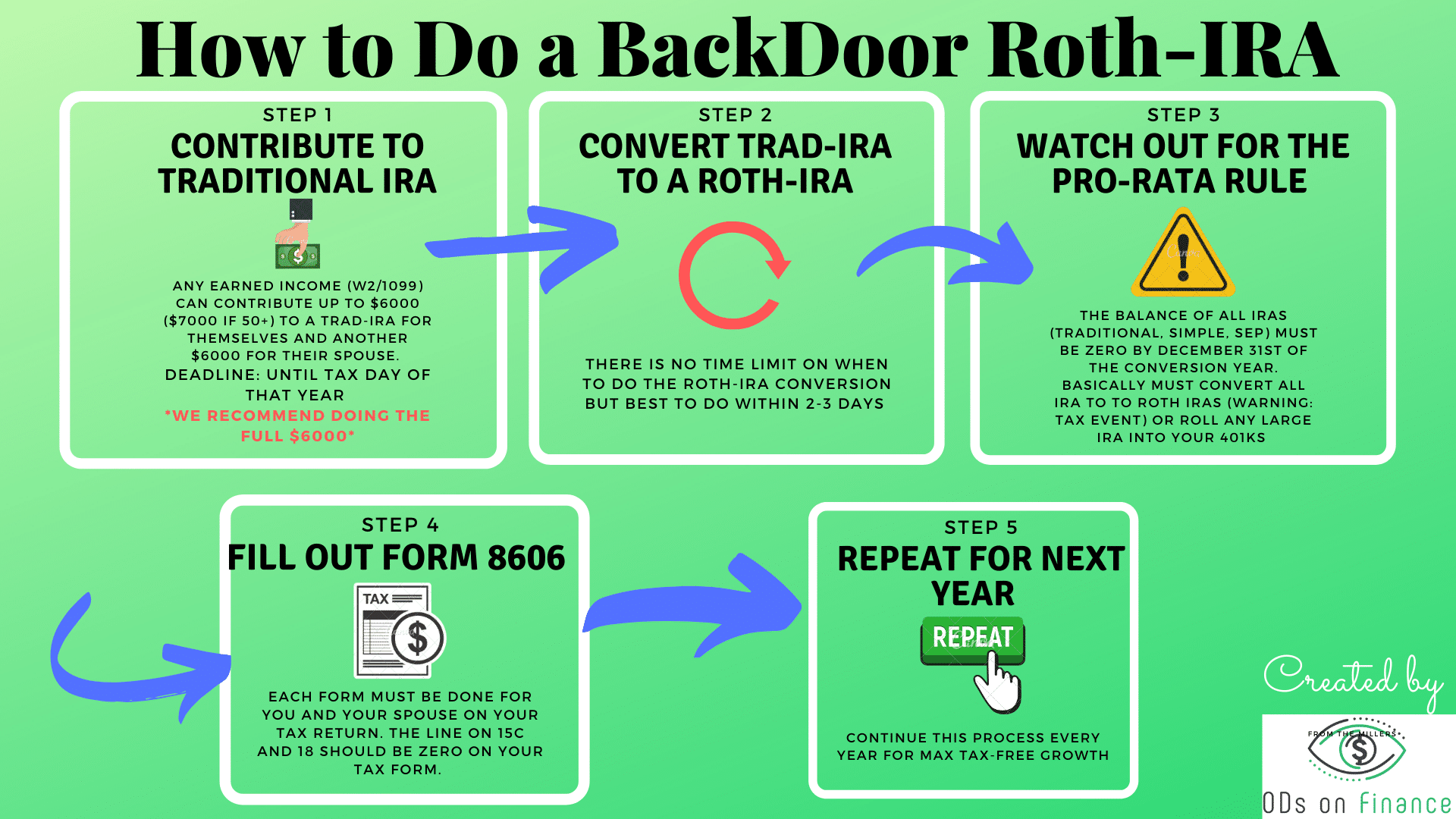

Source: odsonfinance.com

Source: odsonfinance.com

How to do BackDoor Roth IRA ODs on Finance, A backdoor roth ira may be particularly appealing to those who earn too much to contribute directly to a roth ira. In 2024, the contribution limits rise to $7,000, or $8,000 for those 50 and older.

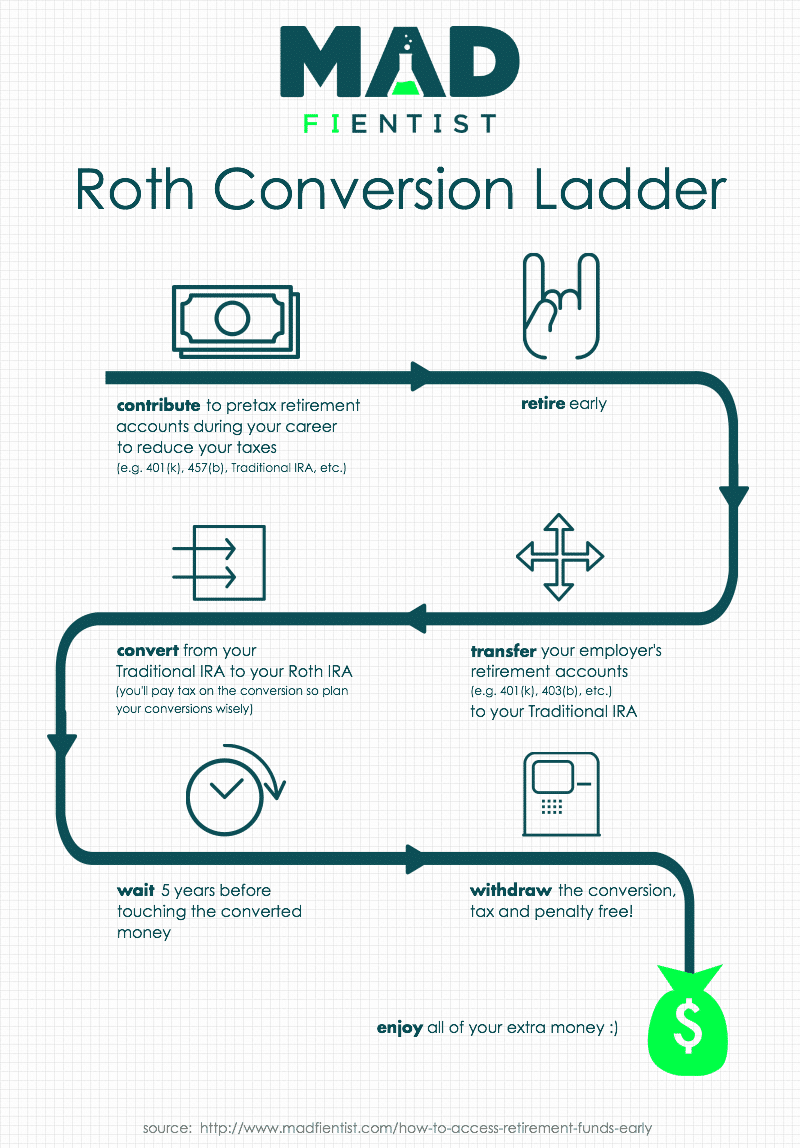

Source: www.listenmoneymatters.com

Source: www.listenmoneymatters.com

The Roth IRA Optimize Your Retirement Savings by Knowing the Rules, A contribution using this backdoor roth ira strategy. That’s because the rules for backdoor roth iras aren’t intuitive.

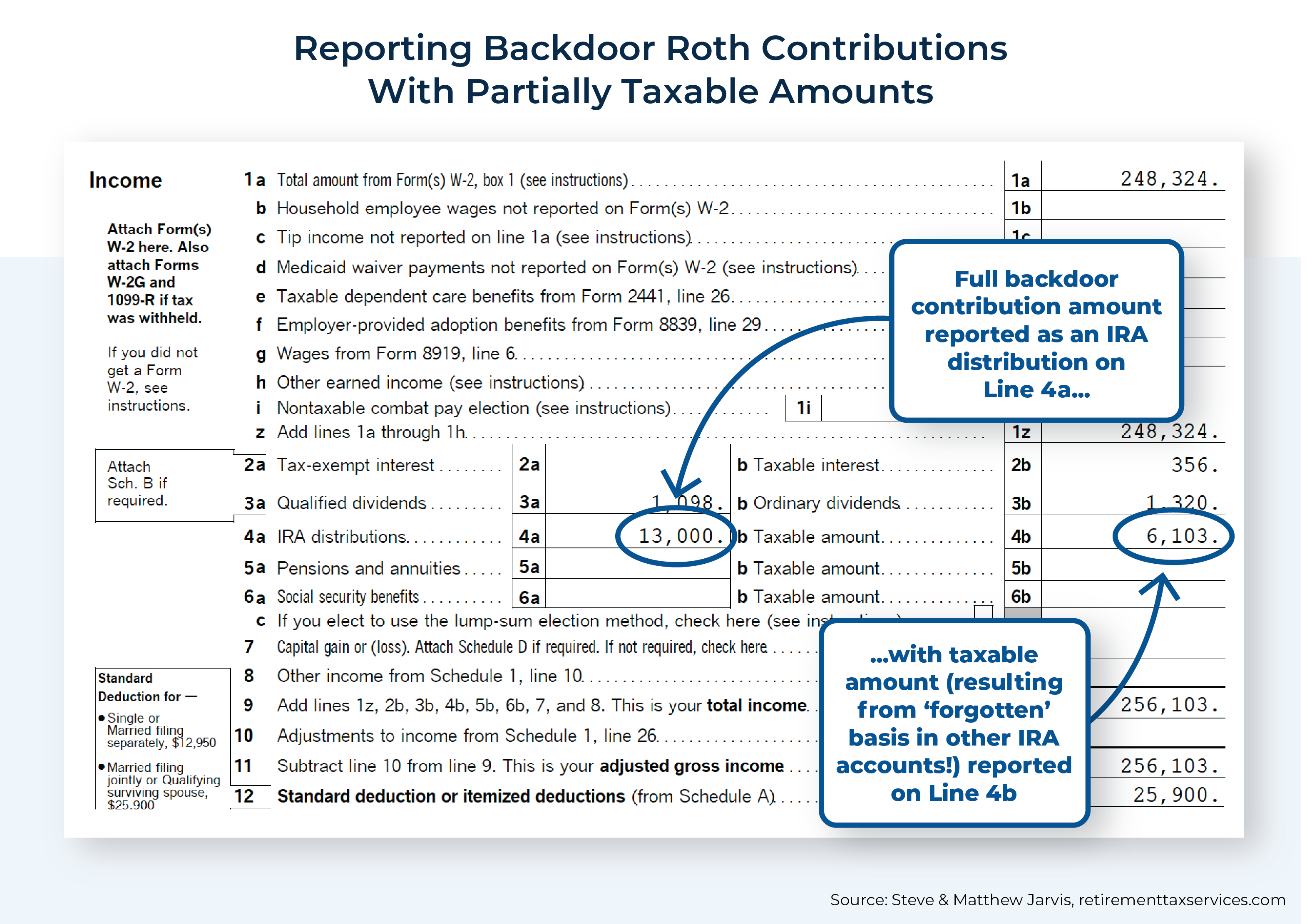

Source: www.kitces.com

Source: www.kitces.com

Effective Backdoor Roth Strategy Rules, IRS Form 8606, A backdoor roth could also be an. How does this add up?

Source: inflationprotection.org

Source: inflationprotection.org

backdoor roth ira conversion rules Inflation Protection, A backdoor roth could also be an. In 2024, the mega backdoor roth strategy allows 401(k) contributions up to $69,000 for those under age 50 and $76,500 for people 50+.

.png?width=940&name=Pro-Rata Rule Diagram Backdoor Roth Conversion (2).png) Source: insights.rgwealth.com

Source: insights.rgwealth.com

How to Avoid the Pro Rata Rule with Backdoor and Mega Roth Conversions, The backdoor roth ira strategy lets you circumvent these limits, although it does involve making additional tax payments. A backdoor roth ira is a way for high income earners to indirectly contribute to a roth ira who would otherwise.

Source: www.youtube.com

Source: www.youtube.com

How to Do a Backdoor Roth IRA YouTube, Yes, even though the build back better act in 2004 was drawn up to end backdoor roth iras by 2020, this financial. For 2024 the maximum rollover is $8,300 for a.

Source: www.youtube.com

Source: www.youtube.com

IRA Basis Rules Warning for Backdoor Roth YouTube, Backdoor roth ira pitfall #1: For determined savers, the backdoor roth ira is an important tool.

Source: millennialmoneyveteran.com

Source: millennialmoneyveteran.com

Backdoor Roth IRA Conversion Overview and StepbyStep Guide, $8,000 if you're age 50 or older. For high income individuals, contributing funds to a roth ira is only possible through a solution known as the “backdoor” roth ira.

Source: yourfinancialpharmacist.com

Source: yourfinancialpharmacist.com

Why Most Pharmacists Should Do a Backdoor Roth IRA, A working spouse can also contribute for a. Backdoor roth ira pitfall #1:

You Can Contribute The Amount Of Your Earned Income Or $7,000 To A Traditional Ira In 2024, Whichever Is Less.

A contribution using this backdoor roth ira strategy.

It’s Easy To See Why:

A working spouse can also contribute for a.